Eden Suite

Home \ Our Services \ Eden Suite

Carbon Management Software

Environmental Data Management and Reporting Solution

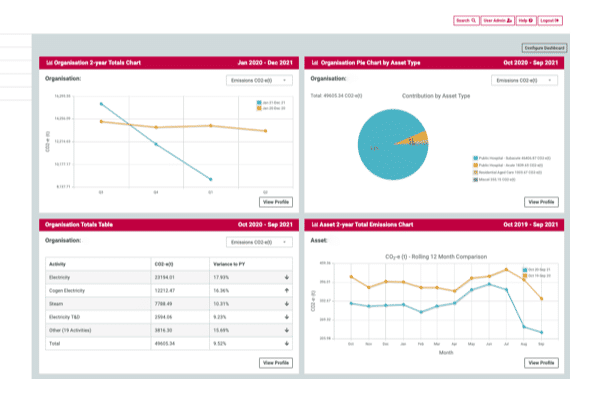

Eden Suite is a powerful web-based solution for all your environmental data and reporting needs including: data management, monitoring, analysis and reporting.

Flexible organisational management

Eden Suite has a comprehensive capability to structure your organisational and asset hierarchies that best align to your reporting needs. It allows you to configure asset and organisational hierarchies against which your data will be captured and reported. The structure can be modified as legislative and organisation requirements evolve.

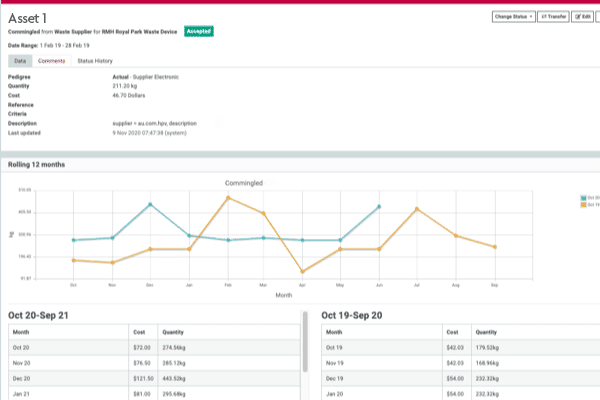

Streamlined data collection

Eden Suite’s data exchange network facilitates the flow of environmental data from all points of your supply chain. This robust ‘portal of information’ allows your data to be presented and used in a number of different ways to support the varying requirements of internal and external stakeholders.

Measure and manage any important activities

Eden Suite enables you to track all necessary activities to report and monitor your carbon and broader environmental footprint such as your energy produced and consumed, water usage, waste management, transport, paper and more. It can also be used to track your broader Corporate Social Responsibility measures.

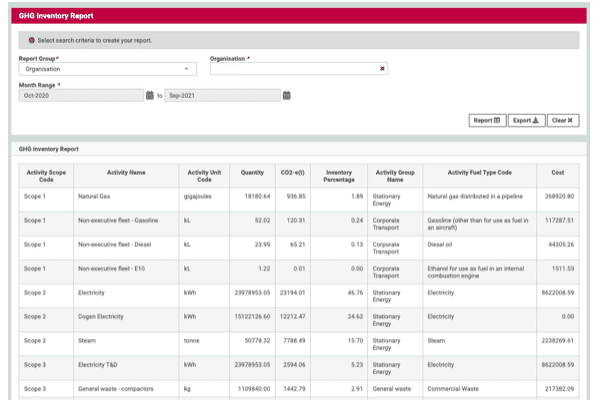

Comply to reporting requirements

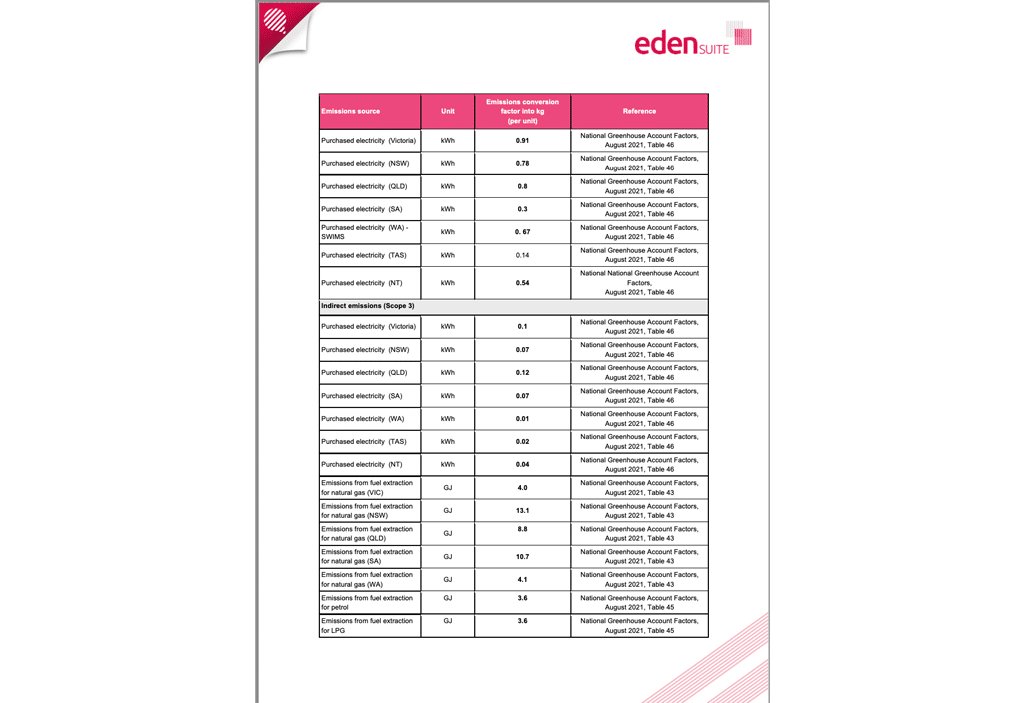

Whether you are required to report your environmental impact legally or choose to do so voluntarily, Eden Suite has a range of reporting structures to meet your needs. Eden Suite maintains all emissions factors to ensure accurate CO2e management. Standard reports are available to meet NGER, NABERS, NCOS and CDP.

Testimonials

Learn more

Download our 2023 Emissions Factors

Download the Full Product Brochure